[ad_1]

Every year, we turn to a panel of trusted analysts to ask them what they see coming down the road, and ask them to assess their predictions from the previous year.

This year we’ve got all of last year’s participants returning: Niko Partners’ Lisa Cosmas Hanson, Midia Research’s Karol Severin (offering the firm’s take alongside Perry Gresham), Kantan Games’ Dr. Serkan Toto, and Ampere Analysis’ Piers Harding-Rolls.

We’ve also got one newcomer in Newzoo’s lead analyst for games Tom Wijman, who will be assessing 2023 predictions made a year ago in a three-part series on the company’s blog.

As always, thanks to all our panelists for taking part in our New Year’s tradition.

Lisa Cosmas Hanson and her team at Niko Partners

Last Year’s Predictions

Mobile, PC and console games will embrace hybrid monetization – Generally true although advertising has yet to emerge on console.

Game related M&A deal value will dip significantly in 2023 – True: There was a sharp decline in deal value.

We anticipate imported game titles in Mainland China to receive ISBN licenses in 2023 for the first time since June of 2021 – True: This happened early in the year.

Blizzard will re-enter China after it ends its partnership with NetEase in January – False: Although we originally didn’t expect the games to re-launch until 2024, so this is now our prediction for this year.

VTuber industry to become more intertwined with Japan’s games industry – True: Hololive even created a game brand.

Korean game rating agency will likely restructure following the scandal of 2022 – True. (Editor’s note: The heads of the Game Rating and Administration Committee’s management planning, game content management, and self-regulatory support departments resigned after an audit discovered an embezzlement scheme where the organization’s funds were diverted to mine Bitcoin.)

Blockchain games to decline in Southeast Asia – True.

More than ten international game companies will open offices in MENA – False .

Esports tournaments will be held in a hybrid online/offline manner – True.

Mobile shooters will drive esports growth in 2023 – Half true: Although PUBG Mobile remains king and Valorant Mobile is not a factor yet.

2024 Predictions

Asia and MENA to account for over 60% of global PC and mobile games revenue

Niko Partners’ ongoing market coverage includes Mainland China, East Asia, Southeast Asia, South Asia and MENA, which accounted for over half of total global spending on video games. When isolating PC and mobile games, these markets have traditionally accounted for just shy of 60% of global player spending. We believe that growth from all markets, but especially India, Indonesia and Egypt, will push these markets over 60% of worldwide totals in 2024, per Niko’s estimates for worldwide as well as our specific market coverage.

Out of App Monetization will account for 25% of mobile games spending in Southeast Asia

“As pressure continues to build, we expect Apple and Google to make further concessions this year, leading to an increase in revenue generated from… alternate payment channels”Lisa Cosmas Hanson

As legislation continues to favor the opening up of walled gardens for mobile platform holders, we see an opportunity for mobile game publishers to generate higher revenues from alternative monetization strategies including out-of-app monetization. As pressure continues to build, we expect Apple and Google to make further concessions this year, leading to an increase in revenue generated from alternative app stores, out-of-app monetization, and other alternate payment channels.

A video game acquisition with a value of over $2.5 billion will be announced (a Top Ten deal)

There was a sharp decline in the total number and value of video game related mergers and acquisitions in 2023 as macroeconomic headwinds, strategy shifts, and weaker performance in new technology sectors impacted deal-making. Niko Partners expects to see a recovery for video game related M&A in 2024, with at least one deal with a value of over $2.5 billion. This would qualify it as one of the top ten largest video game related M&A deals of all time. We expect the buyer or target company to be based in Asia and MENA.

The ratio of female gamers in India and MENA will surpass 40%

Niko research shows, when excluding mainland China, 46% of gamers in Asia and MENA are female. However, this drops to 34% when we isolate India, Saudi Arabia, Egypt and the United Arab Emirates. With increased initiatives for women gamers in these markets, more inclusive games, and a 2x faster growth rate for female gamers compared to male, we project that female gamers will account for a larger share of the gaming population over the next three years.

Instant games will reach over one billion MAUs in Asia and MENA

Super apps such as TikTok, Facebook and WeChat are placing a larger emphasis on instant gaming through mini games and cloud games. While games on these platforms have traditionally been in the hypercasual genre, we are starting to see players embrace hybrid-casual titles through instant gaming platforms, which monetize through both ads and IAPs. We believe these games will be accessed by over a billion users over the next three years and encourage the conversion of non-paying users to payers.

2024 will be a year of new console hardware announcements

2023 was a strong year for console gaming as hardware supply returned to normal and multiple high quality AAA titles launched following prior delays. Niko Partners expects 2024 to be hardware oriented with a next generation console announced by Nintendo. We also expect mid-generation consoles from PlayStation, as well as a new entrant in the dedicated PC gaming handheld segment.

Generative AI will be implemented into games for players

Generative AI became the hottest topic of 2023 and many game companies are already utilizing the technology to support professional game development. However, its utilization across this aspect requires a rethink of game design principles, user acceptance, and poses legal concerns. Instead, we believe games in 2024 will primarily use generative AI to enhance user interaction and experience by including new ways to interact with gameplay systems, NPCs and UGC.

“The esports bubble popped in 2023 and teams, leagues, and sponsors are taking a more cautious and sustainable approach to investment”Lisa Cosmas Hanson

The global esports poles will shift

The esports bubble popped in 2023 and teams, leagues, and sponsors are taking a more cautious and sustainable approach to investment. Esports will have a lower impact in the US and Europe and greater impact in Asia, as well as MENA and LATAM. MENA will continue to grow as an esports business and events hub. Mobile will continue to grow as a platform for esports, while PC esports will remain in decline.

Blizzard will re-enter China in an official capacity

Niko Partners predicted last year that Activision Blizzard would announce a new partner for the China market in 2023, with its games re-launching in 2024. While a new partner was not announced, the company did release some of its games on the international version of Steam, allowing Chinese players to access the titles. In 2024, we expect Blizzard to finally announce an official return to the China market and re-launch its games.

More than 100 import games will receive an ISBN for release in China

China’s video game regulator, the National Press and Publication Administration, issued import game licenses for 98 titles in 2023, up from 44 in 2022, 78 in 2021 and 97 in 2020. While import game approvals have yet to return to highs seen in 2019 or 2017, we see a positive trend for game approvals in 2024. Niko Partners anticipates more than 100 titles from overseas game companies to be approved in 2024, including games issued a license through the domestic approval process as a result of having a China-based developer, publisher and IP license agreement.

Karol Severin and Perry Gresham, Midia Research

Last Year’s Predictions

Value will be king

Right. I wrote, “In 2023, games companies will thus have to navigate the tall order of increasing value for money, while keeping entry costs flat, or ideally lower. Traditional unit sales-dependent business models will struggle in this macroeconomic weather.”

Of course, we’ve seen an unprecedented amount of layoffs, as companies tried to keep costs at bay. Also, games purchases were the weakest performing segment of the global games industry in terms of growth, having only grown 0.1% from 2022 to 2023.

VR Emerges from the trough of disillusionment in 2023

Right. I wrote, “…2023 will see a significant increase in VR ownership and usage. By the end of 2023, VR usage will near double-digit penetration rates in the US.”

In Q2 2023, the VR owner/user penetration in the US was already at 8%, up from 6% in Q2 2022. We are waiting for our Q4 numbers to come back from field, but anticipate this this be even higher. Furthermore, we have seen news of Meta’s Quest Store surpassing $2 billion in sales. Though there is of course still a long way to go for VR (and XR more broadly) to break through from the early adopter niche and reach sustainable profitability, 2023 has certainly seen movement towards the right direction.

Xbox will narrow PlayStation’s lead in terms of console ownership

Wrong. Sony significantly outsold Xbox this year, having proven more resilient in the current competitive landscape than previously expected. However, it is worth noting that Xbox’s strategy going forward does not necessarily hinge on the number of consoles sold, but rather on the number of subscriptions.

2024 Predictions

While in absolute terms, the majority of the planned layoffs would have taken place in 2023, 2024 will not be a walk in park either. The total global games industry is only expected to grow 2.5%, as per MIDiA Research’s forecast, which is well below the anticipated rate of inflation, which means that the industry will be worse off next year, despite growing in absolute terms.

“The total global games industry is only expected to grow 2.5%, as per MIDiA Research’s forecast, which is well below the anticipated rate of inflation”Karol Severin

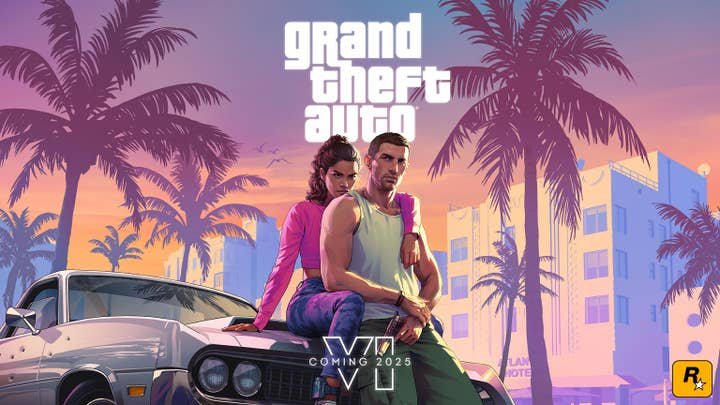

The strength of the release slate looks fairly pale in comparison to 2023, especially now that GTA 6 is coming in 2025. Furthermore, inflation, high interest rates and cost of living crisis will continue to put pressure both on the demand and supply side of games.

(The above thoughts were written by Severin, but the predictions below represent Midia Research’s positions, and are the work of Severin and Gresham both.)

AI to supercharge games development

AI stands to remove, or at least lessen, one of the great barriers of game development: the requirement to code. Meanwhile, advances in game engines, like Unreal Engine, are also lowering barriers to entry. The natural consequence – more people will be able to make games and so more games will be made. The growth of gaming as a whole, and the growing population, will boost this further. Expect even more games to be released in 2024 than 2023, which in itself grew compared to 2022.

AI will also be used directly within games – e.g., for realistic dialogue and more natural behaviours from NPCs (this is already mooted for Dragon’s Dogma 2 and Grand Theft Auto 6). The good: imaginative people with great ideas will be able to make those into games, boosting innovation. Distributors will benefit as all these games have to be sold somewhere. The bad: Much more noise, meaning more opportunity for new release games to be lost.

As time spent on entertainment is already hard to come by, the increasing number of games means even tougher competition, ultimately affecting in-game purchase revenues. Unless consumers are willing to up their spend in the mid-to-long-term, the average developer could end up being worse off.

Games subscription growth to outpace games software growth by three times

“Expect a strong year for games subscriptions, with more growth than in 2023…”Karol Severin

Expect a strong year for games subscriptions, with more growth than in 2023 and total subscriptions closing in on 200 million by the end of the year. Games software will also grow more than in 2023, but it will be significantly outpaced by subscriptions. Consequence – more power for the companies offering subscription services. A dynamic that is similar to music may emerge where, equivalently to Spotify jostling with labels over rightsholder payouts, Microsoft and Sony will be jostling with game publishers. There will be one big difference: Microsoft and Sony also develop and publish their own games in-house, sell the hardware on the games that are played, and control much of the cloud infrastructure behind the scenes. This grants them significantly more relative negotiating power in this situation than Spotify has in music.

Another $100 million-plus acquisition will take place

The broader consolidation trend in the games landscape will continue in 2024 as games companies keep shifting focus towards profitability, time spent, and money earned per hour played. Besides further cost-cutting through tactics such as layoffs, expect more acquisitions of games companies. Potential buyers include large existing games companies (e.g., Sony, NetEase, Nintendo, Valve, Epic Games, EA, and Take Two Interactive) as well as non-games companies expanding further into the space (e.g., Apple, Netflix, Disney, TikTok, Meta, and Amazon). As the added value of a games publisher is being challenged by distributors with direct-to-consumer relationships, traditional games publishers (especially in the mid-to-tail end of the market) may struggle and become acquisition targets by larger entities. Quality games developers will also be of interest as the largest publishers and distributors will keep looking to retain an edge in terms of their content propositions.

Games and social media will eat into time on other formats

Games and social media will gain a portion of time spent on other entertainment sectors. This trend will be fuelled by non-games companies making further strides into deploying interactive games worlds on one side (e.g., Disney, Netflix, etc.), and by traditional games companies including cross-entertainment propositions in-game on the other side. The former will hope to tap into lucrative in-game spending revenue, as well as maintain their brand profile in an increasingly connected age. The latter will do so in hope of growing time spent in-game and mitigating session drop-off rates.

Non-game companies will deepen their involvement with games

In 2024, entertainment companies that are not traditionally pure-play games companies will continue to expand on their foray into games. This includes companies across video, sports, music, and social media, as well fashion and ecommerce. The deepening engagement will be illustrated in a variety of ways, from strategic mergers and acquisitions, in-house investing, and building up IP and infrastructure, through to key strategic partnerships.

Dr. Serkan Toto, Kantan Games

Last Year’s Predictions

Prices will continue to rise – This turned out to be right, especially with regards to subscriptions.

Crypto will see actual games using top IP – Not really, but I believe this will come in 2024.

Crypto might get another Axie Infinity moment – No, even though several games did pretty well in 2023.

Recession will have little effect on gaming – I was referring to the demand and the market size, so I was right in this case. Newzoo actually sees slight growth for the gaming industry in 2023.

2024 Predictions

“Switch 2” will come and be $400

The time is finally here for a Switch successor, even though I can say a “Pro” model actually did exist and certain developers were already working with the dev kit. I believe the next hardware will drop next year for $400. There is a high chance that games will cost more, too: $70. The next system is also likely to be an iteration rather than a revolution. Nintendo might add some bells and whistles to the device, but it will be similar to the current Switch. And because there is Pokémon, and Pokémon is associated with handheld gaming, there is no way on earth Nintendo will drop the portability feature for their next big thing.

“Valuations are down across the board right now, but it will not stay this way for very long”Dr. Serkan Toto

Saudi Arabia will make more big moves

Saudi Arabia has already become a powerhouse in gaming, and 2024 will probably be the year for one of their funds to make at least one more significant move. Valuations are down across the board right now, but it will not stay this way for very long. So it’s a good time for the kingdom to not only invest but outright acquire a top player in the industry. My guess is that following Scopely in 2023, they will take over one of the big video game publishers out there.

AI will become an even bigger topic in 2024

2023 already was the year of AI, and I think AI will radically revolutionize how we develop and play games going forward. In 2024, we will see at least one big launch of a title primarily made with AI. The Finals in 2023 was just the beginning.

Square Enix will release a big IP game with crypto elements

I think after a few years of announcements and experiments, 2024 is the year in which Square Enix will finally launch a big crypto game. My expectation is they are actually going to use the Final Fantasy IP – but probably not for a traditional RPG.

Piers Harding-Rolls, Ampere Analysis

Last Year’s Predictions

Microsoft and Activision Blizzard to merge but with further concessions – Right.

Completion of deal will take place in the second half of 2023 – Right.

Mobile games market to return to growth – TBC, but looking on track.

Mobile version of Microsoft/Xbox store – Wrong.

Console games market to stabilise and return to growth – Right.

PS5 to be the best-selling games console – Right.

No next-gen Nintendo console in 2023 – Right.

Sony’s PSVR 2 to sell 1.2-1.5 million in 2023 – TBC

Meta Quest 3 to launch at the end of 2023 – Right.

Game Pass to grow significantly in 2023 – Right. Starfield release drove adoption; launch of Game Pass Core upped numbers significantly.

More mobile games in Game Pass following King acquisition – Wrong. (Not yet, anyway.)

Sony to secure more day-and-date releases for PS Plus – Right. (Ampere had launch-day additions for Sea of Stars, Meet Your Maker, Teardown, Tchia, Rogue Legacy 2, and Humanity.)

Pure-play cloud gaming services will continue to be a small market opportunity – Right.

Netflix to experiment with streaming of games – Right.

More hybrid monetisation using ads across AAA and subscription services – Wrong. It hasn’t really happened.

Defensive market consolidation and average deal value to continue to decline – Right.

Generative AI experimentation to increase a lot but to not radically impact staffing – Right to an extent. Experimentation has massively increased, but it has also been reported that some industry layoffs have been linked to AI adoption, although it’s not a major contributing factor.

2024 Predictions

2023 was a year of ups and downs. The highs of a long list of exceptional new games versus the lows of the longest run of high-profile industry layoffs that I can remember in my 20+ years in the industry.

“There is still more correction to come as companies come to terms with spiralling costs, more expensive debt, and a more commercially challenging market”Piers Harding-Rolls

I think we can expect more of those highs and lows in 2024. Unfortunately, I don’t think we’re at the end of the industry layoffs. There is still more correction to come as companies come to terms with spiralling costs, more expensive debt, and a more commercially challenging market. This will also lead to continued defensive M&A activity. Savvy Games Group will make at least one major ($1bn+) games acquisition in 2024.

Market performance-wise, I expect low single digital percentage growth across the sector in 2024 but short-term performance remains a little less predictable, especially across PC and mobile gaming. I think the console market will be up marginally, aided by the launch of a next-gen Nintendo console, more than likely a Switch 2, towards the end of the year. PS5 will be the best-selling console. VR will have another tough year. The global PC and mobile gaming markets may see their potential undermined by the adoption of new game regulations in China, such is the importance of that territory. What is clear is that we’ve entered a lower growth era for the sector as a whole which is likely to carry on for the next few years at least.

I expect the big trends in 2024 to focus on:

Generative AI use in games

As publishers and devs struggle with rising budgets, generative AI promises to deliver production efficiency so adoption is broadening. There are still untested legal implications to deal with here so most of the focus will remain on pre-production and operational processes rather than actual gaming content. However, 2024 could be the year we get an interesting example of AI-driven NPCs in-game.

Microsoft and Activision implications

Microsoft will challenge EA to become the biggest publisher across Xbox and PlayStation consoles in terms of player numbers. I’m expecting all future ActiBlizz releases to go into Game Pass on day one (unless there is an existing contract that does not allow that). Game Pass will also be the only multi-game subscription service with day-one inclusion of streamed versions of these new releases. I think it is cost prohibitive for other services. 2024 will see an expansion of the Game Pass offering: more mobile content, a lower cost tier (potentially with ads) and the PC version offered in more markets.

Mobile app store disruption

I expect the status quo to generally continue in 2024 even with Epic’s latest win against Google. We don’t know what the remedies are yet in that case and what we’ve seen in other territories such as South Korea is that both Apple and Google have successfully nullified third-party billing by providing minimal discounts on their charges to publishers for IAP. I think these charges will be the next area of legal challenge. 2024 will see Microsoft experiment with a mobile app store on Android using King content.

“2024 will see Microsoft experiment with a mobile app store on Android using King content”Piers Harding-Rolls

Continued operational convergence between games and video platforms

Netflix will broaden its games streaming offer to more markets and publish more games based on its Originals IP. Sony will use more video content to bolster its PS Plus offering. YouTube Playables will go nowhere.

Content predictions

A MMO resurgence, more turn-based games, continued uptick in gaming IP adaptations in the video space, more AA games from the biggest publishers and some re-balancing of games investment between live service and single-player experiences on console platforms. GTA6 to get a confirmed 2025 launch date by the end of the year that is later than everyone expects.

Tom Wijman, Newzoo

Last Year’s Predictions

Newzoo did not participate in last year’s column but did publish their own 2023 Trends in a 3-part series, which you can read in full here, here, and here.

If you just want a capsule summary, here are Wijman’s assessments of the firm’s calls from 2023.

More AAA to AA publishers will pivot their main franchises to service-based models.

That is not true (yet), as some of the foreseen launches hit a road bump in 2023.

Microsoft-Activision deal will go ahead, but regulators will continue to make an impact.

After a long wait, one of the gaming industry’s largest deals materialized. Microsoft successfully acquired Activision-Blizzard on October 13th, 2023. However, regulatory conditions led to agreements allowing third-party cloud gaming services to stream Microsoft’s (and, by extension, Activision Blizzard’s) games.

PC and console markets to adopt hybrid monetization strategies, including advertising

While diverse monetization approaches are evident, advertising has yet to significantly impact both PC and console markets.

M&A appetite will decline

Despite the closure of major deals, the appetite for mergers and acquisitions is projected to continue its slowdown throughout 2023.

Mobile game user acquisition challenges

As forecasted, user acquisition for (hyper) casual mobile games became more challenging post-ATT (App Tracking Transparency) implementation. Consequently, mobile developers are exploring shifts to the PC and console market—a trend monitored closely in 2024.

Cloud gaming providers embrace Platforms as a Service (PaaS)

A definitive yes to this prediction. Cloud gaming service providers are expanding beyond consumer gaming offerings, investing in Platforms as a Service (PaaS) to support graphically intensive programs, including generative AI tools.

Generative AI will make it easier to develop games

Generative AI simplifies certain development tasks at scale. While we are years away from full-scale AAA design automation, the technology continues to evolve, but use cases are limited for now.

VR gaming will steadily grow

Partly true. VR gaming witnessed steady growth, reaching a base of 30.8 million by year-end 2023 (+15.6% YoY). However, challenges in retaining newly acquired users led to a forecasted decline in spending on VR games to $1.3 billion in 2023.

2024 Predictions

“After a modest recovery in 2023 following the industry’s first decline in over a decade, 2024 promises a robust rebound”Tom Wijman

After a modest recovery in 2023 following the industry’s first decline in over a decade, 2024 promises a robust rebound. The driving force? The ever-expanding user base of the Xbox Series and PlayStation 5 generation. Despite a seemingly lackluster release schedule, live service games and back catalog sales will drive growth in the segment. After two consecutive years of decline, we will also monitor a potential upswing in the mobile gaming sector.

Nintendo Switch 2 will take center stage

Nintendo Switch 2 will launch in 2024 with a highly anticipated 3D Mario game. Having embraced a digital storefront, Nintendo will allow users to transfer between Nintendo accounts to Switch 2; no more building your games library from scratch.

End of the live service domination and market saturation

Live services will continue to be massively successful and dominate top played and grossing charts, undoubtedly, but not every studio will want to develop a live service game anymore. Developers and publishers will pivot back to premium game development. Oversaturation in the PC and console markets is evident, with a handful of titles monopolizing playtime; 60% of playtime is eaten up by 19 games and 75% by the top 33 by playtime.

Entering a fiercely competitive market, especially for live service projects, gaming companies face challenges in 2024. Many live service games in the pipeline will hit the market, each vying for success. The industry, having swiftly descended from the engagement peaks of 2020 and 2021, is undergoing restructuring, making funding for massive projects a lower priority. Venture capital is scarce, making it more challenging for independent studios to secure funding.

Nostalgia takes a key role in live service titles

Established live service titles leverage nostalgia, drawing inspiration from the success of Fortnite OG and World of Warcraft Classic. However, not all live service titles are created equal, and returning to roots does not guarantee a resurgence in player engagement.

Xbox’s strategic move into mobile

Our prediction is that Xbox will launch an Android store in 2024, and later debut on Apple devices. Microsoft’s acquisition of Activision Blizzard (including King) would position it head-to-head with Apple and Google. The regulatory changes provide opportune timing as they force lower boundaries for competitive app stores. However, breaking into Apple’s closed App Store ecosystem may require additional intervention, so it could hinder simultaneous app store launches.

The onslaught of open world Souls-like games

Building on Elden Ring’s massive success in early 2022, numerous studios are set to unveil their take on the open-world Souls-like genre in 2024. We expect a flood of announcements showcasing these projects.

AI in game production

While AI dominated discussions in 2023, 2024 remains too early for widespread AI tools to accelerate game production. AI tools will see selective, proven use cases but won’t revolutionize the industry on a large scale yet.

“AI tools will see selective, proven use cases but won’t revolutionize the industry on a large scale yet”Tom Wijman

The evolution of multi-game subscriptions is over

The growth phase for multi-game subscriptions is over, and the strategy now shifts to profitability. We forecast flat year-over-year growth in multi-game subscriptions, with indie companies showing less enthusiasm due to shrinking deal sizes. Tellingly, compensation for Microsoft CEO Satya Nadella is no longer tied to Game Pass growth.

We believe multi-game subscription services will not fully take over the gaming ecosystem as it has done for music and TV. Gaming is an active hobby, whereas the other two are passive. Most players cannot consume games at the same pace as they can passive forms of entertainment. If a large menu of games is not appealing enough for players to subscribe, the alternative is to provide access to new games on day one, the strategy Xbox uses for its Game Pass service. However, even Microsoft struggles to release new content at a pace to keep the subscription interesting.

A new threat is coming up for multi-game subscription services as well. Roblox and Fortnite are emerging as formidable competitors, offering diverse gaming experiences for free, with the latter recently launching Lego Fortnite, Rocket Racing, and Fortnite Festival. These platforms undoubtedly are and will become highly competitive to all-you-can-play subscription services.

Mobile-to-PC gaming evolution

Against challenging market conditions and privacy regulations, the mobile gaming segment declined in 2023. Game companies adapt by evolving existing games instead of launching new games, a shift driven by rising user acquisition costs and market saturation. Instead, they are exploring the strategy of launching mobile games on PC to enhance retention and engagement, aligning with the evolving preferences of core players. The goal is to be available whenever players want to dive into the gaming experience.

[ad_2]

Source link