[ad_1]

Press release – regulated information

-

Realised a step change in company’s approach to product development with the move to the AGROBODY™ 2.0 technology platform

-

Successfully closed a €7 million private placement in June at €6.166 per share, subscribed to by Agri Investment Fund and the Belgian Sovereign Wealth Fund

-

Established key partnerships and academic collaborations for the product pipeline and platform

-

Announced results of final round of independent field trials with first candidate biofungicide EVOCA™* while progressing the regulatory review dossier

-

Year-end cash and cash equivalents amounted to €21.6 million, higher than anticipated thanks to focus on core R&D capabilities and streamlining of the organisation

-

Management to host a conference call and live webcast at 15:00 CET / 14:00 GMT / 09:00 AM ET today, details below

Ghent, BELGIUM, Feb. 22, 2024 (GLOBE NEWSWIRE) — – Biotalys (Euronext – BTLS), an Agricultural Technology (AgTech) company developing protein-based biocontrols for sustainable crop protection, today announces key business achievements and consolidated financial results for 2023, prepared in accordance with IFRS as adopted by the European Union, and an outlook for 2024. The annual report, including the full financial report, will be published on the company’s website on 20 March 2024.

Kevin Helash, Chief Executive Officer of Biotalys, stated: “Biotalys made significant inroads in 2023 by progressing to the second-generation of our technology platform and forging new partnerships and scientific collaborations, while carefully managing our cash position. For 2024, we plan to initiate field trials in grapes with our next pipeline program BioFun-6, building on the promising results in independent field trials with EVOCA. We will also continue to work with the competent authorities to obtain regulatory approval, further expand our product pipeline and optimise our technology platform.”

Operational Highlights

Throughout 2023, Biotalys continued to cement its role of innovator in the biocontrol space and created internal efficiencies while advancing its technology platform and product development pipeline.

AGROBODY 2.0 Technology Platform:

-

Following a strategic review of the company in Q3 of 2023, the company announced a shift to the AGROBODY 2.0 platform to develop its protein-based biocontrols for crop protection. This next-generation AGROBODY technology is aimed at increasing the potency and efficacy of the company’s bioactive agents with multiple modes of action while lowering cost of goods, allowing for a broader market penetration of our biocontrol products.

Partnerships:

Product Validation:

-

EVOCA, Biotalys’ first protein-based biocontrol candidate aimed at targeting botrytis bunch rot and powdery mildew in fruits and vegetables, continued to demonstrate its efficacy in extensive global field trials, both in the company’s own trial program as well as in independent academic trials in the U.S. Biotalys now considers its EVOCA field testing complete given the in-depth dossier of supporting independent data comparing its performance with conventional chemical and biological fungicide products.

Pipeline Update:

-

Now laser-focused on novel biofungicide and bioinsecticide solutions, the company refined its product pipeline in November. The status of the various programs is as follows:

-

Biotalys continues to work with the EPA (Environmental Protection Agency) in the U.S. and the CTGB (College voor de Toelating van Gewasbeschermingsmiddelen en Biociden) in Europe on EVOCA’s regulatory review. Pending the decision, the company continues to pave the way for its next generation of the product (EVOCA NG), a biofungicide program with the same bioactive as EVOCA but an optimized production process and formulation, leading to lower production costs which results in an attractive commercial potential. EVOCA NG is expected to be the company’s first margin-generating product in both the US and EU.

-

BioFun-4, the biofungicide program targeting Phytophthora infestans, an Oomycete (water mould) that causes late blight/potato blight, a serious disease that particularly affects fruits and vegetable crops and potatoes, is proceeding. The company entered into a research collaboration with the University of Aberdeen (UK), within which the company will sponsor a three-year PhD project in the Oomycete Laboratory of Prof. Pieter van West, Chair in Mycology, a leader in the field, to deepen its expertise in Oomycetes on the molecular level. This fits well with Biotalys’ highly targeted strategy as the core of its AGROBODY™ 2.0 technology platform.

-

BioFun-6, the biofungicide program targeting botrytis, powdery mildew and anthracnose in fruits and vegetables, is in the final stages of discovery and lead molecules are expected to be tested in field trials in the course of 2024.

-

BioFun-7, the biofungicide program in collaboration with the Bill & Melinda Gates Foundation, targeting leafspot disease in cowpeas and other legumes, is advancing and supported by new academic collaborations with the Instituto Superior de Agronomia (Dr. Filipa Monteiro and Prof. Dora Batista) at the University of Lisbon (Portugal), and the lab of Prof. Ioannis Stergiopoulos at the University of California-Davis (US).

-

BioIns-2, the bioinsecticide program in collaboration with Syngenta Crop Protection, targeting key pests, is advancing as planned.

-

Leadership Updates:

Outlook for 2024

-

With its focus now squarely on advancing the second-generation technology platform, AGROBODY 2.0, Biotalys will continue to concentrate resources on core R&D capabilities, as well as on obtaining registration for its first product candidate EVOCA.

-

Pending the regulatory decision for EVOCA, the company will continue the development of EVOCA NG which is set out to be the first margin-generating product for the company.

-

Building on its successful field trial program, Biotalys plans to initiate field trials in grapes for BioFun-6 in the course of 2024.

-

The company will progress its pipeline programs and expects to initiate a new R&D biofungicide program for a new pathogen in the first half of 2024.

-

Together with the cash and cash equivalents balance of €21.6 million at the end of 2023, the company expects the financial runway to extend until the end of April 2025 without considering any additional financing through equity, newly awarded grants, partnerships or other sources of financing.

Special Shareholders Meeting

At the board meeting dated 21 February 2024, the board established that based on the non-consolidated Belgian GAAP financial statements for the period ending 31 December 2023, the net assets of the Company (€22,751,230.29) dropped below half of the corporate capital of the Company (€46,198,455.95) triggering the procedure under article 7:228 of the Belgian Code on Companies and Associations (“BCCA”). In accordance therewith, the Board will convene a special shareholders meeting on March 29, 2024 and propose to the shareholders the continuation of the activities of the Company. The convening notice and the related documentation including the special board report as required under article 7:228 BCCA will become available on the website of the Company in the next few days. At the occasion of this special shareholders meeting, the board will also propose the confirmation of the nomination of Mr. Kevin Helash as director of the Company.

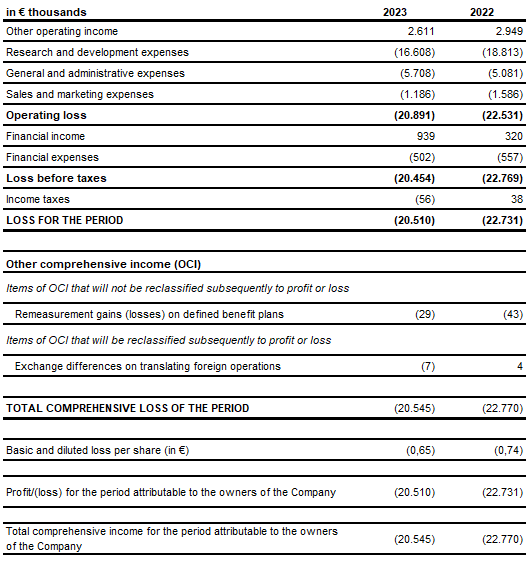

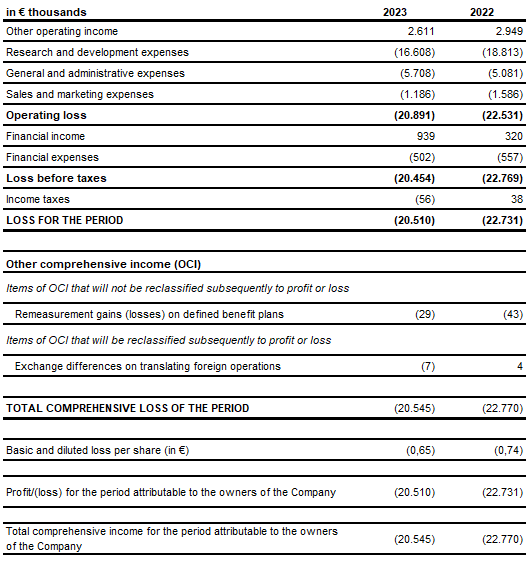

Detailed financial review for 2023

|

In € thousand |

2023 |

2022 |

|

|

|

|||

|

Other operating income |

2,611 |

2,949 |

|

|

Research and development expenses |

(16,608) |

(18,813) |

|

|

General and administration expenses |

(5,708) |

(5,081) |

|

|

Marketing expenses |

(1,186) |

(1,586) |

|

|

Operating loss |

(20,891) |

(22,531) |

|

|

Financial income |

939 |

320 |

|

|

Financial expenses |

(502) |

(557) |

|

|

Loss before taxes |

(20,454) |

(22,769) |

|

|

Income taxes |

(56) |

38 |

|

|

Loss for the period |

(20,510) |

(22,731) |

|

|

Remeasurement gains (losses) on defined benefit plans |

(29) |

(43) |

|

|

Exchange differences on translating foreign operations |

(7) |

4 |

|

|

Total comprehensive loss for the period |

(20,545) |

(22,770) |

|

|

Basic and diluted loss per share (in EUR) |

(0.65) |

(0.74) |

|

|

Profit/(loss) for the period attributable to the owners of the company |

(20,510) |

(22,731) |

|

|

Total comprehensive income for the period attributable to the owners of the company |

(20,545) |

(22,770) |

|

|

Cash and cash equivalents |

21,570 |

34,096 |

|

|

Net increase (decrease) in cash and cash equivalents |

(12,521) |

(22,017) |

|

Consolidated statements of profit and loss

-

Other operating income amounted to €2.6 million and relates to R&D tax incentives received and grants awarded to support R&D activities. Income from the grant from the Bill & Melinda Gates Foundation increased by €0.3 million. R&D tax incentives remained at €0.7 million, while income from government grants decreased by €0.6 million compared to 2022 as several of these funded projects are coming to an end.

-

Research and development expenses amounted to €16.6 million for 2023, a decrease of €2.2 million compared to 2022, mainly caused by a reduction of external spending for the production of EVOCA and for other collaborations, combined with a reduced number of field trials for product testing.

-

General and administrative expenses amounted to €5.7 million for 2023, compared to €5.1 million in 2022. This increase is partly driven by one-time costs in relation to the implemented changes in the organisation.

-

Marketing expenses decreased from €1.6 million in 2022 to €1.2 million in 2023, as a result of lower costs for the stock option program following the changes in the Marketing & Sales organisation in the second half of the year.

-

Financial income amounted to €0.9 million in 2023, compared to €0.3 million in 2022, primarily due to the increased interests received on bank deposits, which were negative in 2022.

-

Financial expenses amounted to €0.5 million and are related to interest expenses for the leases and bank loans and foreign exchange losses.

-

Income taxes expenses show the impact of the reversal of a deferred tax asset related to the R&D expenses in our U.S. subsidiary.

-

Loss of the period was €20.6 million in 2023, compared to €22.8 million in 2022.

-

Basic and diluted loss per share for 2023 amounted to €0.65 compared to €0.74 in 2022. The average number of shares outstanding in 2023 increased versus 2022, as a result of the capital increase in June.

-

Cash and cash equivalents at year-end amounted to €21.6 million in 2023 (compared to €34.1 million in 2022), slightly higher than expected as a result of a combination of savings in external R&D expenses and organisational changes implemented by management.

Auditor Statement

The consolidated financial statements have been prepared in accordance with IFRS, as adopted by the EU. The financial information included in this press release is an extract from the full IFRS consolidated financial statements, which will be published on 20 March 2024. The statutory auditor, Deloitte Bedrijfsrevisoren /Réviseurs d’Entreprises, represented by Pieter-Jan Van Durme, has confirmed that its audit procedures, which have been substantially completed, have not revealed any material adjustment that should be made in the accounting information included in this press release.

Financial calendar and upcoming IR events

-

28 February 2024: Biotalys’ management will attend the Regenerative Food Systems Investment conference in Brussels

-

4 March 2024: Biotalys’ management will give a keynote speech at Danum Advisor’s Knowledge Day in Amsterdam dedicated to investment in biodiversity

-

18-19 March 2024: Biotalys’ management will participate at the annual ROTH MKM investor conference in California

-

19-20 March 2024: Biotalys’ management will participate at the annual World AgriTech Forum in San Francisco

-

20 March 2024: Online publication of the Biotalys annual report for 2023

-

23 March 2024: Biotalys’ management will speak at the Flemish Retail Investor Association (VFB) Annual Happening in Antwerp

-

29 March 2024: Special shareholders meeting

-

16 April 2024: Biotalys will host a site visit for the investor branch of Markant, an organisation for active and entrepreneurial women, at its HQ and labs in Ghent

-

23 April 2024: Biotalys will hold its Annual General Shareholders Meeting at its HQ in Ghent

Live webcast and conference call

Company management will host a live webcast in English to discuss its full year 2023 financial results and business highlights today, Thursday, 22 February 2024 at 15:00 CET / 14:00 GMT / 09:00 AM ET and can be accessed via the following link: https://edge.media-server.com/mmc/p/uwteb7ve/.

Dial-in details: To ask questions live to management, please register for the conference call via the following link: https://register.vevent.com/register/BIe76a08c1a0544f40a864e04bbf066d2d.

A recording of the webcast will be available after the event on the Biotalys investor website: https://www.biotalys.com/investors/financial-information.

* EVOCA™: Pending Registration. This product is not currently registered for sale or use in the United States, the European Union, or elsewhere and is not being offered for sale.

-End-

About Biotalys

Biotalys is an Agricultural Technology (AgTech) company developing protein-based biocontrol solutions for the protection of crops and food and aiming to provide alternatives to conventional chemical pesticides for a more sustainable and safer food supply. Based on its novel AGROBODY™ technology platform, Biotalys is developing a strong and diverse pipeline of effective product candidates with a favorable safety profile that aim to address key crop pests and diseases across the whole value chain, from soil to plate. Biotalys was founded in 2013 as a spin-off from the VIB (Flanders Institute for Biotechnology) and has been listed on Euronext Brussels since July 2021. The company is based in the biotech cluster in Ghent, Belgium. More information can be found on www.biotalys.com.

For further information, please contact:

Toon Musschoot, Head of IR & Communication

T: +32 (0)9 274 54 00

E: IR@biotalys.com

Important Notice

Biotalys, its business, prospects and financial position remain exposed and subject to risks and uncertainties. A description of and reference to these risks and uncertainties can be found in the 2022 annual report on the consolidated annual accounts published on the company’s website.

This announcement contains statements which are “forward-looking statements” or could be considered as such. These forward-looking statements can be identified by the use of forward-looking terminology, including the words ‘aim’, ‘believe’, ‘estimate’, ‘anticipate’, ‘expect’, ‘intend’, ‘may’, ‘will’, ‘plan’, ‘continue’, ‘ongoing’, ‘possible’, ‘predict’, ‘plans’, ‘target’, ‘seek’, ‘would’ or ‘should’, and contain statements made by the company regarding the intended results of its strategy. By their nature, forward-looking statements involve risks and uncertainties and readers are warned that none of these forward-looking statements offers any guarantee of future performance. Biotalys’ actual results may differ materially from those predicted by the forward-looking statements. Biotalys makes no undertaking whatsoever to publish updates or adjustments to these forward-looking statements, unless required to do so by law.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEARS ENDED 31 DECEMBER

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARS ENDED 31 DECEMBER

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARS ENDED 31 DECEMBER

[ad_2]

Source link