[ad_1]

- Nvidia is experiencing high demand for its AI chips.

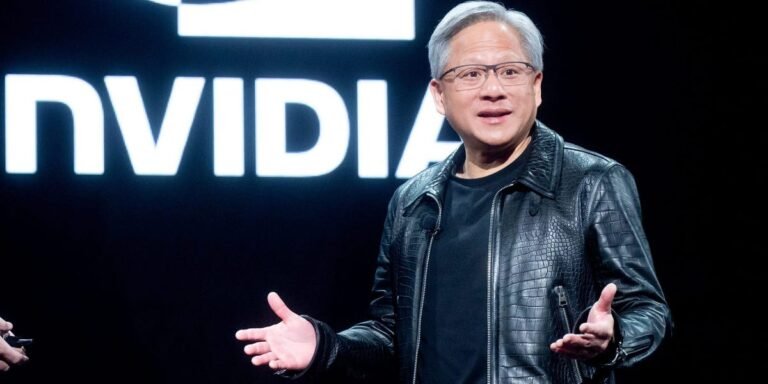

- CEO Jensen Huang assured analysts that the company distributes chips “fairly.”

- Nvidia’s fourth-quarter revenue exceeded Wall Street expectations, reaching $22.1 billion.

Hot chip stock Nvidia has a problem, but it’s a good problem.

Demand for the company’s AI chips is so high that co-founder and CEO Jensen Huang was forced to assure the company that it was allocating them “fairly.” .

“We strive for fair allocation and do our best to avoid unnecessary allocations,” Huang said on a call with analysts after Wednesday’s fourth-quarter earnings release, according to the transcript.

Huang was responding to a question about how NVIDIA allocates chips to all the companies seeking to acquire it, many of which are competitors.

Huang added that NVIDIA will work with cloud service providers to meet their expectations and timelines.

“Why allocate something when the data center isn’t ready? There’s nothing harder than leaving something out,” Huang said, adding that NVIDIA is “allocating something unnecessarily. He said he wanted to avoid “quotas.”

After all, companies in everything from healthcare and financial services to self-driving cars are getting into the AI game.

“Fundamentally, we want to allocate fairly while avoiding waste and looking for opportunities to connect partners and end users,” he added.

Nvidia reported another explosive quarter on Wednesday, with revenue of $22.1 billion. That’s up 265% from a year ago and exceeded Wall Street expectations.

The chipmaker’s stock price has tumbled over the past year since the AI boom sparked by OpenAI’s ChatGPT pushed the technology into the mainstream.

“Accelerated computing and generative AI are reaching a tipping point. Demand is surging across companies, industries, and nations around the world,” Huang said in a press release Wednesday.

Nvidia’s stock price has more than doubled in the past 12 months, and analysts are worried that the semiconductor giant will soon lose momentum.

Even Ark Invest’s Cathie Wood questioned the stock price, saying: wall street journal On Sunday’s podcast, he said the company has become an overvalued “checkbox stock.”

Nvidia shares rose 9.1% to $735.94 per share in after-hours trading Wednesday after the earnings release. Year-to-date, it’s up 36%.

[ad_2]

Source link